If you notice any strange or unusual activity on your bank statement, notify your bank immediately.

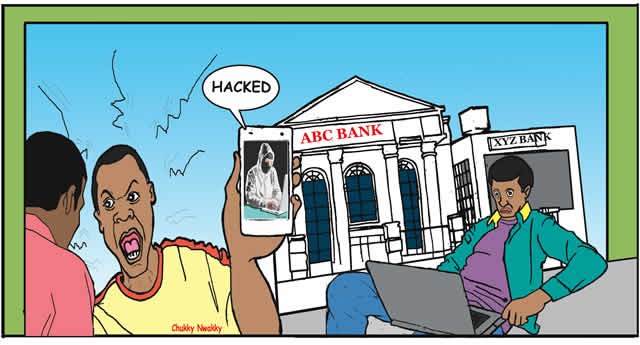

Cyberattacks

on banks happen every day but not to worry, most banks are well

protected against hackers. A threat of a cyberattack should not deter

you from using a financial institution.

But in the case your account has been hacked…

Signs you’ve been hacked

Strange purchases that appear on

your bank statement may be the first clue that a hacker has infiltrated

your account. Always read credit card and bank statements, paying close

attention to match the transactions to your activity.

Sometimes, you’ll notice seemingly small, yet unfamiliar purchases.

Thieves often do that to test if your card will work before making

larger purchases.

Depending on your bank, it will notify you of

suspicious activity and automatically cancel fraudulent charges and

issue you a new card.

Lost or stolen card numbers

If you realise your card has

been lost or stolen, contact your bank right away. Don’t wait for your

bank to notify you of fraudulent activity.

Once you notify your

bank of you missing card, it will freeze your account, blocking any

purchases or payments. You can either visit a local branch for a

temporary card or wait for a new card to come in the mail.

If any unauthorised purchases are made, most banks will refund you the lost money.

You don’t need to panic unnecessarily over the safety of your bank account. Here’s why your bank accounts are safe from hackers:

Banks are liable

If a hacker steals money from a bank, the

customer won’t lose money; the bank is liable to pay the money back to

the customer. Banks are improving security. Since banks are constantly

under attack, they need to improve every aspect of their security so

they have the latest software designed to protect you and your money.

Every attack doesn’t make the news, but generally the big ones do. Banks

are constantly improving their systems for detecting and dealing with

these problems.

Ensure your account is not vulnerable

Most banking websites

allow you to activate a feature called “remember your password” when you

log in via the Internet. This allows you to skip several layers of

security the next time you log in since the bank recognises your

computer’s IPv4 address — a unique identifier for each Internet

connection.

Malware is a tool that hackers use to imitate your

IPv4 address so they can gain access to your bank account. Often you

don’t even know that they have control over your bank account.

Therefore, it’s best to disable the “remember your computer” feature.

Steps to staying safe while banking

According to banking experts, here are some steps to help keep your banking transaction safe.

Keep your passwords and pins safe

That means not giving

them out to anyone, including family or friends or anyone soliciting

them over email. Also try not to write them down.

Check for site security

Most legitimate sites will have privacy and security terms that you can review. Secure URLs start with https — not http.

Avoid public networks for banking

That

means no quick peeks at your finances while you’re out shopping or

working. Using public networks can compromise your personal security and

put your information at risk.

Don’t give your contact info to strangers

Confirm who is calling or writing first before providing any information.

Don’t necessarily answer security questions honestly

The

name of your first pet won’t be verified, so you can choose a different

word. Just make sure that whatever you use is memorable to avoid being

locked out of your account.

Use more characters and symbols in your password

The more

characters in your password the better. Random letters interspersed with

numbers and special characters will take much longer for software to

crack than a simple series of numbers. Likewise, the same random

assortment will make it harder for someone to simply guess your

password.

Listen to your gut

Remember that your

intuition is a quick series of patterns recognised by your subconscious.

If your gut tells you something is off, it truly could be.

Report suspicious activity

Report any suspicious people or

unverifiable companies soliciting your banking information. You may

also want to contact your bank.

Run antivirus and anti-malware software

Doing so could end up preventing computer viruses and losing your information.

Double-check your transactions

Look over your statements for any fraudulent purchases, and report anything suspicious right away.

By The Punch’s Oyetunji Abioye